- 26 Elmwood Avenue, Colchester, Essex CO2 9HT, UK.

- +44 74 95508340

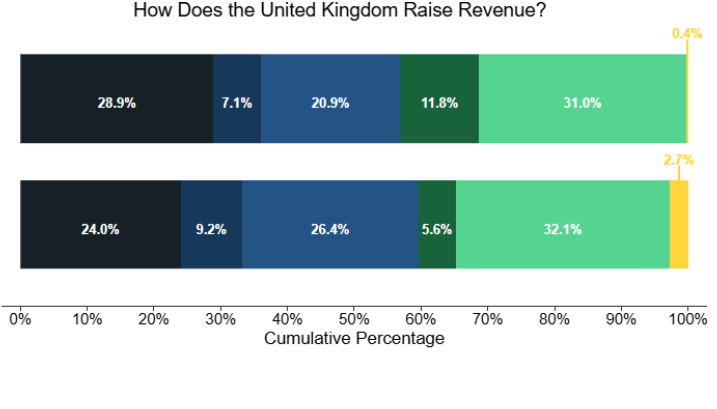

In the United Kingdom, the system of taxation involves contributions to various tiers of government including the central government, devolved administrations, and local authorities. The primary sources of revenue for the central government include income tax, National Insurance contributions, value-added tax (VAT), corporation tax, and duties on fuel.

On the other hand, local governments mainly derive their funds from government-provided grants, local business taxes in England, and Council Tax, along with additional income from various service charges, like those for public parking.

Financial autonomy allows local governments to cater to community-specific needs through the collection of Council Tax, which varies depending on property values and local policy decisions. Additionally, local governments benefit from the business rates collected from commercial properties, which provide a significant portion of their budget.

This tiered taxation structure not only fuels the essential services at the local level but also supports broader national initiatives, helping to balance economic stability across regions. Meanwhile, devolved governments have powers to adjust certain taxes, which enables them to tailor fiscal policies to regional priorities and economic conditions.

In the United Kingdom, tax revenue is generated from a diverse range of sources including individual and corporate income taxes, social security contributions, taxes on goods and services, and property taxes. The composition of these tax policies can significantly influence the economic impact of the tax system.

While income taxes can potentially disrupt economic activities more than other forms of taxation, the reliance on different types of taxes varies greatly from one country to another. This variation allows for tailored fiscal strategies that can either minimize economic distortion or target specific economic behaviors.

In the UK, corporations are taxed on their profits through the corporate income tax, a common practice among OECD countries. However, the specifics such as tax rates and allowable deductions can vary significantly between nations. Generally considered as one of the more growth-inhibiting forms of taxation, corporate income taxes can be offset to some extent by lower tax rates and favorable capital allowances.

These allowances are crucial as they affect a company’s willingness to invest in new capital. Typically, expenses from such investments are not immediately deductible; businesses must spread this cost over the lifespan of the asset. The degree to which these costs can be deducted, reflecting in the asset’s present value, plays a significant role in encouraging or discouraging business investment, which is a key driver of economic expansion.

Compared to most English-speaking developed nations like Australia, Canada, New Zealand, Ireland, and the United States, the UK's tax rates are relatively higher. However, they remain significantly lower than the average found in many western European countries, where tax revenue constitutes around 39.9% of GDP.

The standard VAT rate in the UK is 20%, applicable to most goods and services. A reduced rate of 5% applies to specific items like children's car seats and domestic energy. Additionally, there is a zero rate for certain essential products, including most food items and children's clothing.

The UK government generates approximately £1 trillion annually, primarily from three major taxes: income tax, National Insurance Contributions (NICs), and Value Added Tax (VAT).

Pro Tax Consult offers expert tax consulting and advisory services, ensuring legal certainty and efficient tax strategy for individuals and businesses. Trust our personalized solutions to support and optimize.

Copyright © 2025 Pro Tax Consult. All Rights Reserved. Design by: Extreme Digital Work